From Rappler (May 15, 2023): Pension reform: DND fears majority of enlisted soldiers will opt to retire (By BONZ MAGSAMBOL)

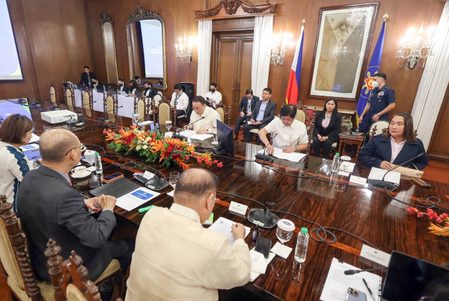

Department of National Defense OIC Carlito Galvez Jr. appeals to senators for a 'middle ground'

MANILA, Philippines – An estimated 70 to 80% of the military’s enlisted soldiers may opt to retire early if the current plan to fix the pension system pushes through, Department of National Defense (DND) officer-in-charge Carlito Galvez Jr. told the Senate on Monday, May 15.

Galvez said that his department has been holding consultations with soldiers on a proposed law to reform the military pension system, which government said has been draining coffers and can no longer be sustained. The plan has “affected morale,” he said.

Among the proposals are to stop the automatic indexation of pension according to the salaries of active-duty personnel; to mandate contributions from the military and uniformed personnel (MUP); and to release their pension only a year after they reach the mandatory retirement age of 56, or when they are 57. The current system grants them pension when they turn 56.

“We anticipated that around 70 to 80% of our enlisted personnel, who are eligible for optional retirement, will gonna retire. Ang gusto nila ‘yung pension ng current systems,” Galvez said. A soldier may opt to retire after serving for 20 years in the armed forces.

Galvez said the department is proposing a “middle ground,” which is that only new entrants to the military should be covered by the new law. “There’s no problem if the new system will be given to the new entrants. They all unanimously agree,” Galvez said. Otherwise, the military might be deluged with thousands of soldiers opting to retire early, causing bigger organizational problems.

“If this is still financially impossible, we are very amenable and open to modifications in the system so long as these are fair and equitable to the military and the MUP and also this is based on the financial soundness and scientific actuarial science.”

Galvez cited one issue that has spawned “adverse reactions” from enlisted men: That the lump sum they are going to receive will be reduced “from 36 months to 18 months.”

“While we fully support the enactment of legislative measures to address the current issues hounding the pension system, the DND and the AFP respectfully appeal that the morale and welfare be given due weight in this deliberations, considering that the mere notion of modernizing our pension system already created some sort of apprehension,” Galvez said.

During the Senate hearing, the Department of Finance presented the following key reforms on the pension system of the military.The new policy will cover all active personnel and new entrants, meaning mandatory contributions begin with those currently or about to enter service.

It will seek the removal of automatic indexation of pension to the salary of active personnel of similar ranks. This means pensions will no longer increase according to the salary increases of active personnel.

Military uniformed personnel will receive their pensions at the age of 57. The current policy allows them to receive their pensions at 56, the mandatory retirement age.

Mandatory contributions will be required for active personnel and new entrants, similar to the pension fund for government employees, the Government Service Insurance System. The percentage of the mandatory contribution will be staggered over a uniformed personnel’s years of service – from 5% in their first three years, to eventually 9% of their salary.

National Treasurer Rosalia de Leon echoed a statement of Finance Secretary Benjamin Diokno in March, saying that the current pension system is “unsustainable.”

“The threat for the government would be unable to meet its pension commitments or improve the country’s defense posture is real. We’re already spending significantly on pension liabilities than keeping our military and uniformed services safe, competent, and in fighting shape,” she said.

If the system is not fixed, De Leon said that pension spending is projected to increase in the next years, and is projected to go up to P1.5 trillion in 2040.

Data from the Department of Finance showed that the share of unfunded MUP pension liabilities in the gross domestic product of the country in 2020 stands at 53.4%, or P9.6 trillion.

Slide from Department of Finance’s presentation

Careful study

Senator Ronald dela Rosa said this should be studied carefully.

“Ayusin natin ito. Damned if you do, damned if you don’t. Pag nagkaroon ng fiscal collapse dahil pinapaboran natin ang MUP, tayo ang sisihin ng taumbayan. In the same manner, kapag nagkakaroon tayo ng weak national defense because of a very demoralized soldiers, dahil pinaboran natin ang economic managers, tayo ang sisihin. Kaya nag iingat kami ngayon dito,” he said.

(We need to fix this. Damned if you do, damned if you don’t. If there will be fiscal collapse because we favored the MUP, the public will blame us. If we would have weak defense because of demoralized soldiers, because we favored our economic managers, we will also be blamed. That’s why we’re looking into this carefully.)

There were talks to introduce MUP pension reforms under the Duterte administration, but those proposals fell through, partly through lobbying from former military personnel who are pensioners themselves – officials who held key posts in politics and governance.

MUP refers to personnel from the Armed Forces of the Philippines, Bureau of Fire Protection, Bureau of Jail Management and Penology, Philippine Coast Guard, the Philippine Public Safety College, the Bureau of Corrections, and the Philippine National Police.

https://www.rappler.com/nation/department-of-national-defense-fears-early-retirement-pension-reform/

Senator Ronald dela Rosa said this should be studied carefully.

“Ayusin natin ito. Damned if you do, damned if you don’t. Pag nagkaroon ng fiscal collapse dahil pinapaboran natin ang MUP, tayo ang sisihin ng taumbayan. In the same manner, kapag nagkakaroon tayo ng weak national defense because of a very demoralized soldiers, dahil pinaboran natin ang economic managers, tayo ang sisihin. Kaya nag iingat kami ngayon dito,” he said.

(We need to fix this. Damned if you do, damned if you don’t. If there will be fiscal collapse because we favored the MUP, the public will blame us. If we would have weak defense because of demoralized soldiers, because we favored our economic managers, we will also be blamed. That’s why we’re looking into this carefully.)

There were talks to introduce MUP pension reforms under the Duterte administration, but those proposals fell through, partly through lobbying from former military personnel who are pensioners themselves – officials who held key posts in politics and governance.

MUP refers to personnel from the Armed Forces of the Philippines, Bureau of Fire Protection, Bureau of Jail Management and Penology, Philippine Coast Guard, the Philippine Public Safety College, the Bureau of Corrections, and the Philippine National Police.

https://www.rappler.com/nation/department-of-national-defense-fears-early-retirement-pension-reform/

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.